At the event, on behalf of An Phat Holdings, Mr. Dinh Xuan Cuong, Vice Chairman and Chief Executive Officer was honored to receive ASEAN Business Awards for Skills Development category. This is a great recognition from the Government and state agencies for the Group in developing human resources and successfully building a skilled workforce, especially in the Industry 4.0 era that aiming for a competitive and dynamic ASEAN economic community.

Formerly a small business with a few employees, after nearly 20 years of establishment and development, APH has become the leading high-tech and eco-friendly plastics Group in Southeast Asia, owning a team of nearly 5,000 employees staffed by more than 5,000 employees with 15 member companies operating in many fields: Compostable materials and finished products; Packaging; Engineering plastics and SPC flooring; Raw material and chemicals for plastics industry; Precision engineering & molding; Industrial real estate etc.

With a hierarchical organizational structure staffed by more than 5,000 employees, APH always focuses on training, improving quality, enhancing professional skills and skills of employees. In addition, APH also have policies to attract and retain talent.

About the award, Mr. Dinh Xuan Cuong – Vice Chairman and Chief Executive Officer of An Phat Holdings shared: “The ASEAN Business Awards is an international recognition for APH’s human resource development over the past time. Besides production and business activities, we always value human element as the most important business resource. We have been and will continue to build and develop high-quality, skilled human resources that are also the key factor to APH’s constant development.”

Also, within the framework of the ceremony, Ms. Dang Thi Quynh Phuong, General Director of APH’s member companies was honored to receive “Young Entrepreneur 2020” award presented by Deputy Prime Minister Truong Hoa Binh. The ASEAN Business Advisory Council (ASEAN BAC) highly appreciated Ms. Phuong’s ability to lead, manage and develop successful corporate brands in the market, as well as her contributions to building business networks for AnEco compostable products. At APH, Ms. Phuong is also a young leader making great contributions to market expansion and business development of the Group’s member companies.

The ASEAN Business Awards is a prestigious regional award that has been annually organized by ASEAN BAC since 2007. After 14 years, ABA has made a bold impression, honoring outstanding businesses and entrepreneurs that make invaluable contributions to the development and prosperity of the ASEAN community. The Awards are also the informational platform within the ASEAN Economic Community (AEC) to promote regional and global integration.

In the context of complicated developments of the Covid-19 outbreak, An Phat Holdings still maintains its position as the leading high-tech and eco-friendly plastics Group in Southeast Asia, promoting production and export activities, focus on human resource development, searching for new markets, research and development of green products and raw materials… Accordingly, in the third quarter of 2020, APH recorded a 21% increase in profit over the same period, export activities continue to maintain growth momentum, export packaging output

increased 12% over the same period and is expected to grow strongly in the last months of the year.

In particular, APH shares of An Phat Holdings are one of four Vietnamese stocks officially added to the MSCI Frontier Markets Small Cap Index by MSCI (Leading global index provider) since December 2020. Index. APH’s addition to the MSCI index after only 3 months of listing helps to improve APH’s reputation and image as well as increase opportunities to access capital from investment funds.

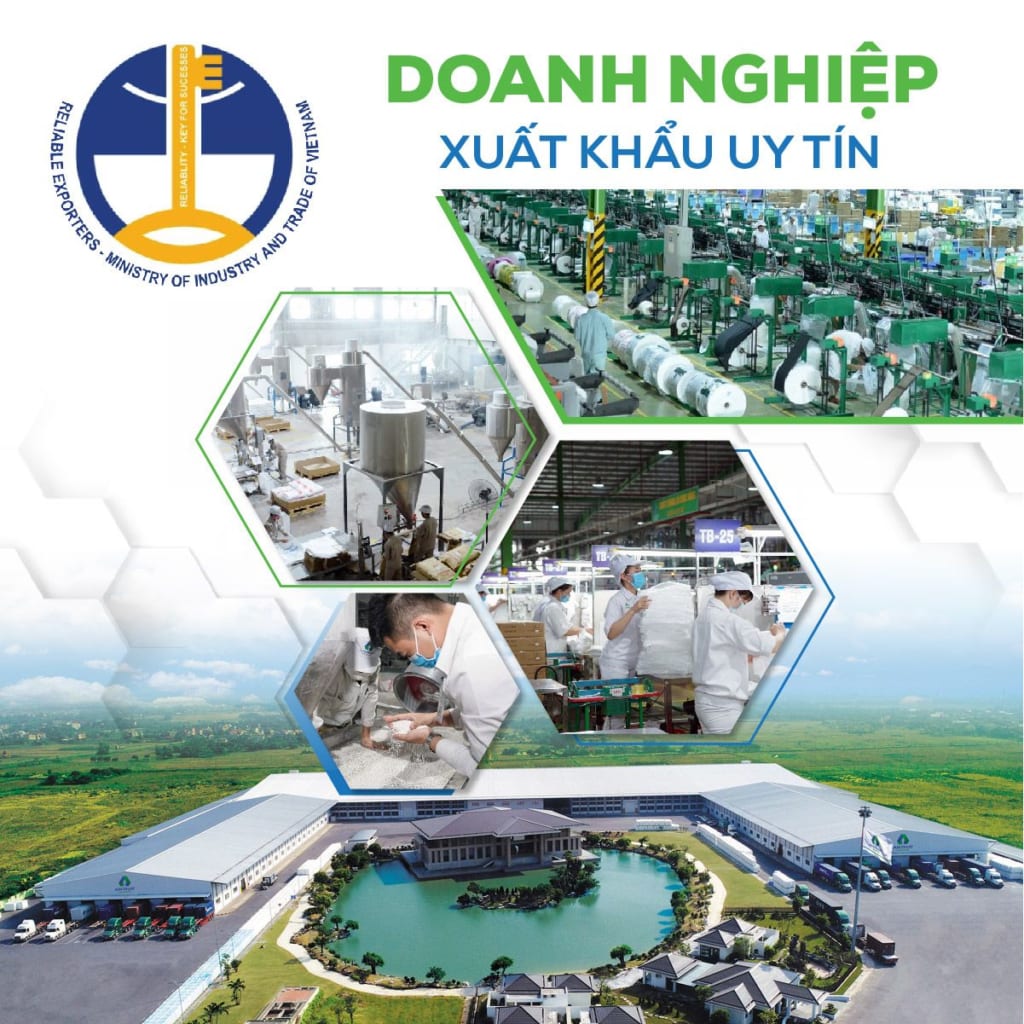

In 2020, APH continuously received many awards and honors from prestigious domestic and international organizations such as: Corporate Excellence and Master Entrepreneur at the Asia Pacific Enterprise Awards (APEA) 2020, Top 50 Best-performing companies, Reliable Exporters, Top Fastest Growing enterprise (FAST500), etc. This is a demonstration of APH’s efforts and contributions to economic development, fostering connectivity and integration between Vietnam and the region.

| An Phat Holdings currently has 15 member companies, including 4 listed companies: An Phat Holdings (Ticker symbol: APH), An Phat Xanh Bioplastics JSC (Ticker symbol: AAA), Hanoi Plastics JSC (Ticker symbol: NHH) and An Tien Industries JSC (Ticker symbol: HII)

With a diversified plastic industry ecosystem, An Phat Holdings has affirmed its brand, prestige and position to make its products present in nearly 70 countries such as Europe, America, the United Arab Emirates, and Japan. , Korea, Singapore, Taiwan, Philippines … Specifically, in thin monolayer film, An Phat Holdings is currently the largest manufacturer in Southeast Asia. In the supporting industry, the Group is a reliable partner of many multinational companies such as Honda, Toyota, Samsung, Piaggio, LG Electronics … In the field of materials and chemicals in plastic industry, An Phat Holdings is the leading plastic resin trader in Vietnam. In addition, An Phat Holdings also affirmed its position as a reputable exporter for items such as plastic additives, high-tech interior plastic products … Expanding and investing in the field of industrial real estate, An Phat Holdings also obtained many achievements with 2 large industrial zones. In particular, An Phat Holdings is the first enterprise in Vietnam and one of the few companies in the world to successfully produce AnBio compostable material and compostable product meeting international standards under brand name AnEco. The Group is promoting investment in the construction of the first and largest green material manufacturing plant in Vietnam with a capacity of 20,000 tons per year to serve the needs of domestic and foreign production and export of raw materials and green products. An Phat Holdings is on the way to becoming the biggest high-tech bioplastics group in Southeast Asia. The group sets a revenue target of 2025 at US$1 billion. |